Volatility Trade Losses – VIX, XIV, SVXY, ZIV, VMIN

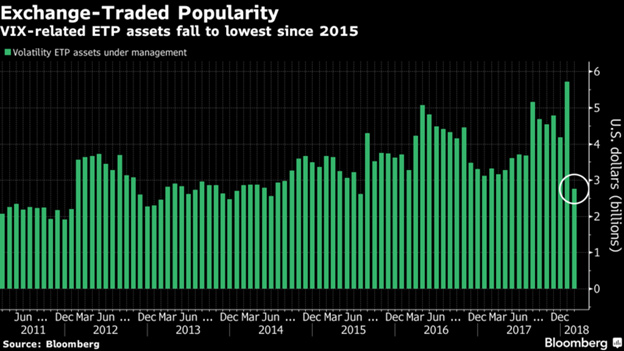

In the last few years volatility has been the hottest trade on Wall Street. Banks have cobbled together investments linked to volatility in the stock market, these products have grown in size. Now with the most recent downturn in the markets investors face stiff losses as a result of a moment in the VIX.

Wall Street firms have created more than $8 billion of products tied to one index alone. In a low-interest-rate world, investors desperate for returns snapped them up, and bankers collected fees along the way.

But, as with mortgage investments a decade ago, complacency – in this case, over a history-defying period of market calm – hid potential dangers.

The fallout from the implosion of this vast array of arcane bets mounted quickly on Tuesday. Credit Suisse moved to liquidate one investment product and more than a dozen others were halted after their values sunk toward zero.

The meltdown began last week when stocks started to plunge and volatility spiked to levels not seen since 2015. The VIX – officially, the CBOE Volatility Index – surged to 50 on Tuesday, before dropping to 30. The index was started by the Chicago-based exchange.

If you are an investor that lost more than $100,000 in volatility related losses you should consider all legal options. If you wish to discuss your particular situation and the potential for the recovery of your investment losses, or you have information of interest, please contact us for an evaluation of your potential case.